The company is now planning to raise another $40 billion for future Bitcoin accumulation.

Michael Saylor, co-founder and chairman of MicroStrategy, made a bold move that caught the attention of the entire financial world. In 2020, in the context of the software company’s stagnant revenue, Saylor decided to change MicroStrategy’s financial strategy by investing heavily in Bitcoin. This has pushed MicroStrategy, a relatively low-key company, into one of the leading names in financial assets in the global corporate world.

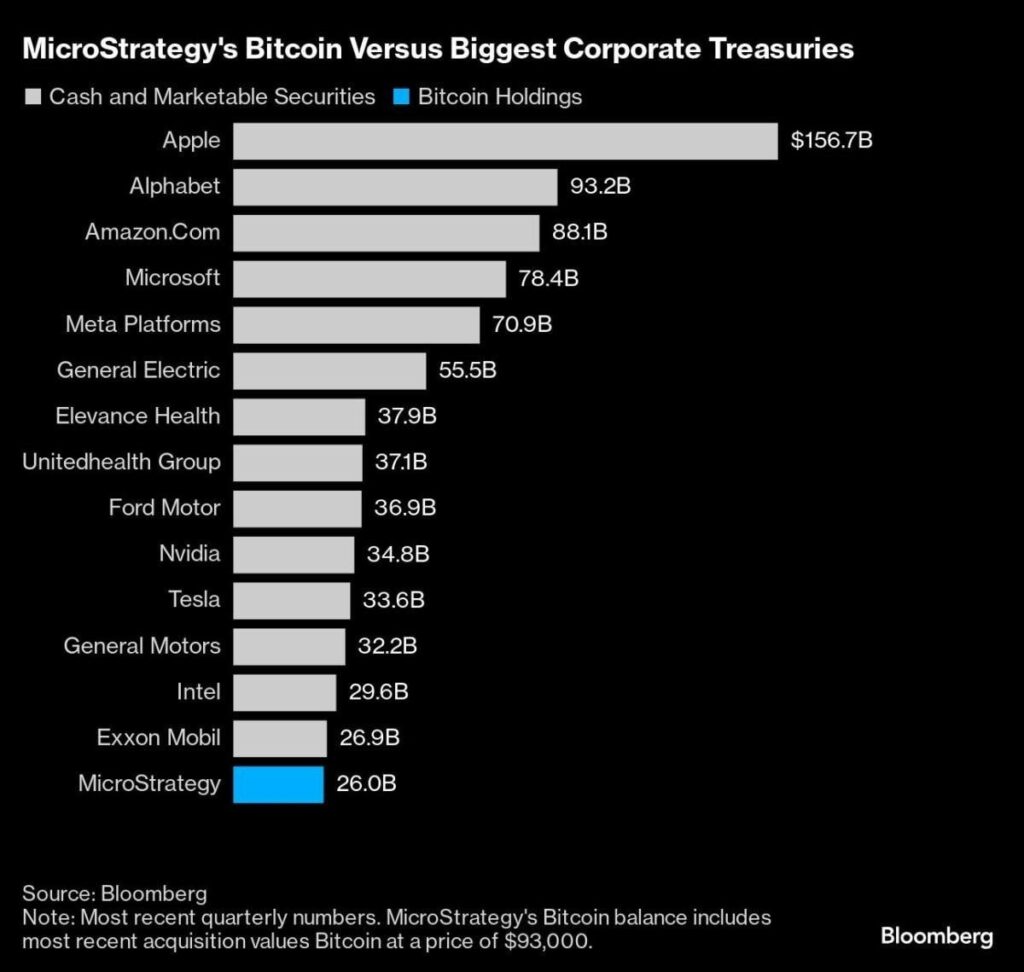

Currently, MicroStrategy is holding about $26 billion worth of Bitcoin, surpassing leading companies such as IBM, Nike and Johnson & Johnson in terms of cash and available securities. With this strategy, MicroStrategy is now only behind a few companies such as Apple and Alphabet in terms of the size of financial assets in corporate treasury. Saylor’s decision, though considered unorthodox, has proven to be surprisingly effective in creating shareholder value.

Initially, Saylor used MicroStrategy’s operating cash to buy Bitcoin. Then, to expand further, Saylor sought to raise capital through the issuance of shares and convertible bonds.

With this bold approach, MicroStrategy quickly became the world’s largest publicly traded Bitcoin holding company. Even in 2022, when the company was still saddled with $2.4 billion in debt, Saylor continued to buy Bitcoin as the price plummeted to the $20,000 range. Just last week, the company announced that it had spent more than $2 billion to buy 27,200 Bitcoins.

Interestingly, this strategy is not only a hedge against inflation but also a way to create breakthrough value. Mr. Saylor didn’t just stop at buying Bitcoin, he also took advantage of market volatility to reinvest profits into the digital asset.

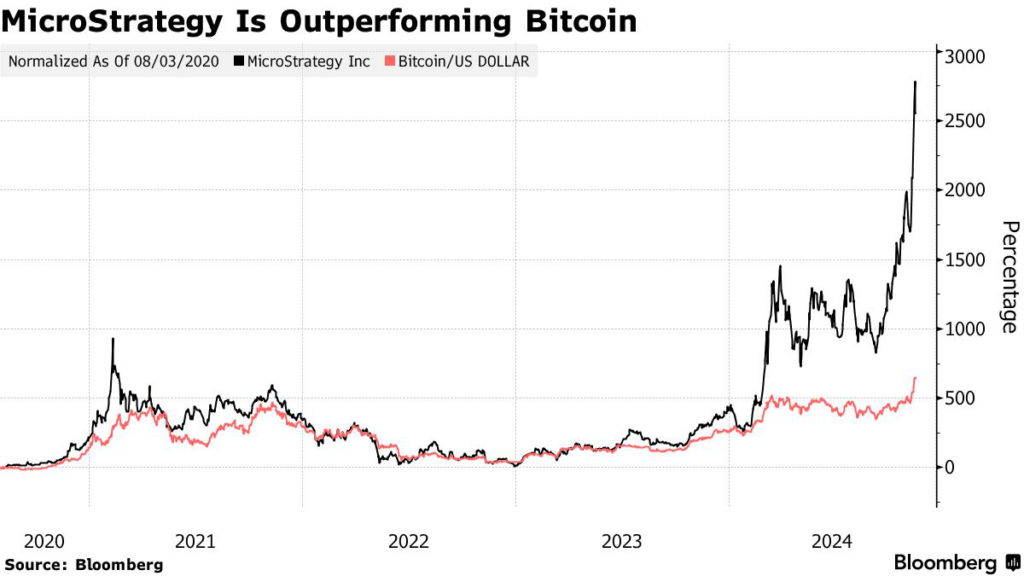

Since MicroStrategy began accumulating Bitcoin, the company’s stock price has increased by more than 2,500%, while Bitcoin’s price has increased by about 700% since mid-2020. This is a clear testament to the effectiveness of this strategy. For many investors, owning MicroStrategy shares has become a way to participate in the Bitcoin market without directly owning or managing the cryptocurrency. This eliminates the hassle of having a wallet or a cryptocurrency exchange, while also capitalizing on Bitcoin’s explosive growth.

Another notable aspect of MicroStrategy’s strategy is the development of a proprietary performance metric called “Bitcoin Yield.” This metric tracks the percentage change in the ratio between the amount of Bitcoin held by the company and the number of shares diluted from period to period. According to the latest report, the company’s Bitcoin Yield in 2024 is 26.4%.

According to Mr. Saylor, the increase in this metric shows the increase in shareholder value in the company’s buy-and-hold Bitcoin strategy, even if the company does not pay dividends to shareholders.

Looking ahead, Mr. Saylor has affirmed that MicroStrategy will not abandon this strategy. He even set a goal of raising an additional $42 billion over the next three years to continue accumulating Bitcoin. This shows that the company does not see Bitcoin holding as a temporary strategy but as a core part of its long-term development orientation. The total cost that MicroStrategy has spent to buy Bitcoin to date is about $11.9 billion, which is only half of its current value. It’s an investment with a staggering return and a testament to Saylor’s bold strategy.

However, relying on Bitcoin also exposes MicroStrategy to risks. The company’s assets are largely dependent on the volatility of Bitcoin, an asset class known for its volatility. But analysts say the market is now embracing MicroStrategy’s approach. Lance Vitanza, an analyst at TD Cowen, said that raising capital from the market to buy Bitcoin is not just a hedge but also an opportunistic way to boost shareholder value. He stressed that this strategy of periodic value creation deserves appreciation.

Not only Vitanza, Mark Palmer, an analyst at Benchmark Co., also has a positive view of MicroStrategy. He said that with Bitcoin’s growth trend in 2024, the company has no reason to change its current strategy. Palmer even predicts that this strategy will continue to yield huge returns, despite short-term fluctuations in the crypto market.

Overall, Michael Saylor’s decision has turned MicroStrategy into an impressive success story in the corporate world. From a little-known software company, MicroStrategy has now become a symbol of boldness and innovation in the financial sector. While there are still controversies and risks surrounding this strategy, there is no denying that Saylor has paved a new path for how businesses can leverage digital assets to create superior value.