If the deal is successful, Truth Social will acquire Bakkt through a stock swap transaction, with the current valuation of Bakkt at around $150 million.

According to information from the Financial Times, in the early morning of November 19, Trump Media and Technology Group (TMTG), a company in which Donald Trump holds a majority stake and is the owner of the social networking platform Truth Social, was reported to be in the final stages of negotiations to acquire Bakkt – a cryptocurrency exchange from New York, under the Intercontinental Exchange (ICE).

If successful, the acquisition is expected to be a stock swap transaction with the current valuation of Bakkt at around $150 million. If successful, TMTG will own this platform from Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange (NYSE), which currently holds 55% of Bakkt shares.

Kelly Loeffler, Bakkt’s first CEO, is considered an important link connecting this trading platform with Donald Trump’s team. In the past, Loeffler served as a Senator from Georgia before losing the 2021 election.

Loeffler’s presence on Trump’s team not only strengthens the relationship between Bakkt and TMTG but also contributes to increasing the possibility of realizing this deal.

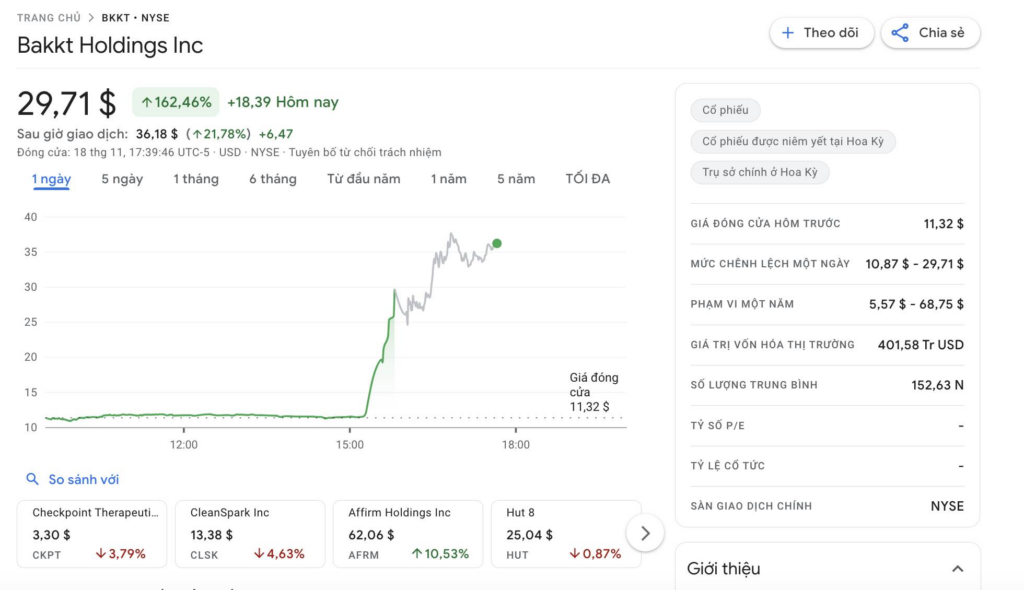

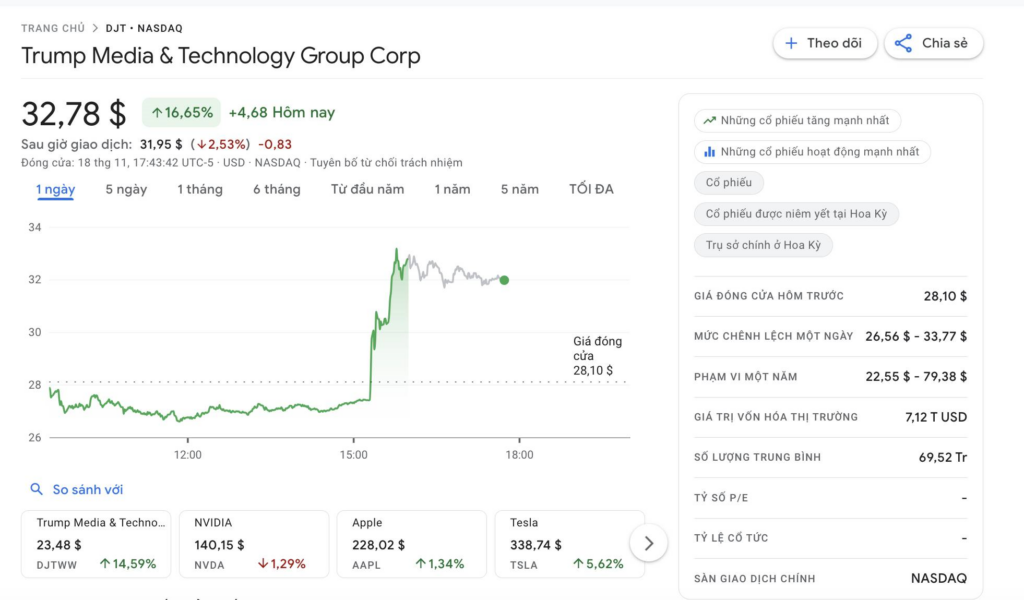

Immediately after the news of the deal was announced, Bakkt’s stock skyrocketed more than 162%, even being suspended several times due to excessive price volatility. TMTG’s stock also recorded an increase of more than 16.7%, with many expecting that this deal will significantly expand the company’s influence in the crypto field.

Founded by ICE in 2018, Bakkt was expected to be a crypto exchange that would bring cryptocurrencies into the traditional financial markets. Initially, the platform launched with physically settled Bitcoin futures contracts but failed to gain the expected traction. In October 2022, ICE announced a $1.4 billion write-down on its investment in Bakkt

In an effort to improve its performance, Bakkt has made several strategic changes, from launching a crypto debit card to planning to expand operations to Hong Kong, the UK and the EU. However, these changes have not helped the company escape losses. In Q3 2024, Bakkt reported a loss of $27,000 on revenue of $328,000. Bakkt is now planning to cease its custody operations to focus on developing a trading platform for institutional investors.

Donald Trump’s majority-owned TMTG (53%) is gradually turning Truth Social into an important tool in his influence-building strategy. The company currently has a market capitalization of up to $7 billion, despite only achieving $2.6 million in revenue in 2024 and reporting a net loss of $363 million.

This net loss is due to Truth Social’s operations averaging only 646,000 daily visits, a small number compared to the 155 million of the X platform (former Twitter).

The acquisition of Bakkt is not only a strategic move by TMTG but also marks a major step forward in Donald Trump’s expansion of influence in the crypto field.

Bitcoin price after Trump’s re-election has set a new ATH, reflecting the expectation that the Trump administration will bring favorable policies to the industry with many outstanding commitments such as the announcement of firing SEC Chairman Gary Gensler, who is considered unfriendly to crypto, pardoning Ross Ulbricht, founder of Silk Road, and the ambition to make the United States “the crypto capital of the world”.

Donald Trump has not only initiated crypto-related projects such as NFT series, now launched 4 NFT series. Recently, DeFi protocol called World Liberty Financial, founded by the Trump family, has attracted attention with the goal of replacing traditional banks. This protocol has nurtured many big plans including launching its own stablecoin and proposing integration on the Aave V3 platform.

However, World Liberty Financial’s fundraising journey has not been entirely smooth. The project initially set a target of raising $300 million, but after only raising $9.8 million in the first 12 hours of the WLFI token sale, the fundraising target had to be reduced to $30 million.