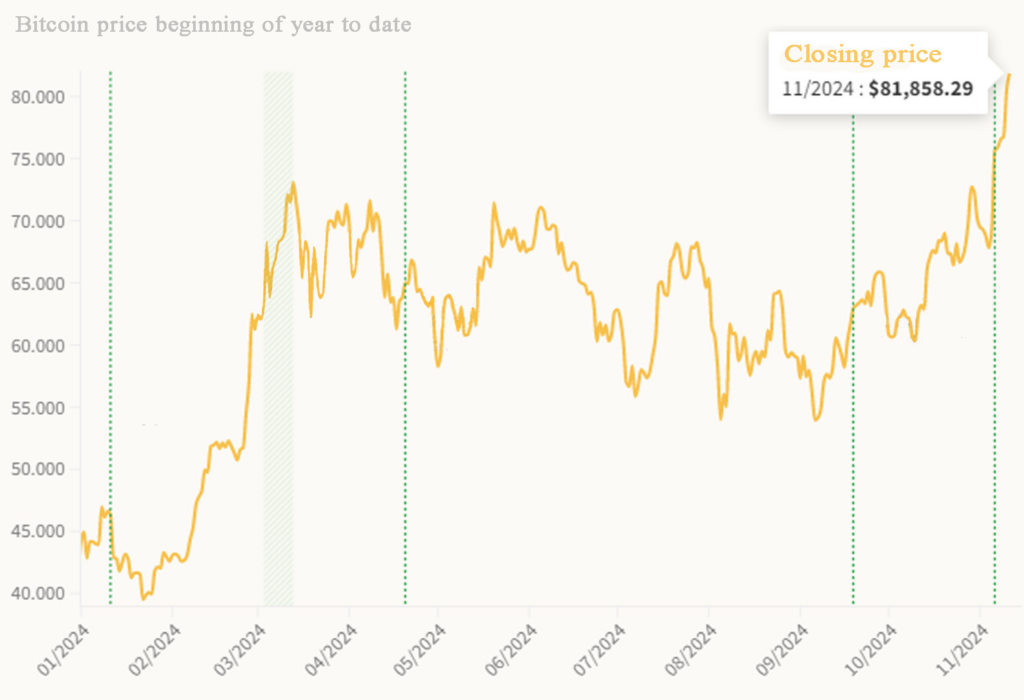

Bitcoin price continuously peaked after Donald Trump was elected President of the United States and planned to develop the cryptocurrency market, making investors more excited.

After soaring to 80,000 USD per coin on the evening of November 10 (Hanoi time), Bitcoin (BTC) set a new record late this morning with more than 81,858 USD. Thus, since Donald Trump was identified as the winning candidate in the race to the White House, BTC has set a new price level every day.

From the previous price range of around 69,000 USD per coin to the peak this morning, the world’s largest cryptocurrency has increased by about 12,700 USD, or nearly 18.5% in less than a week.

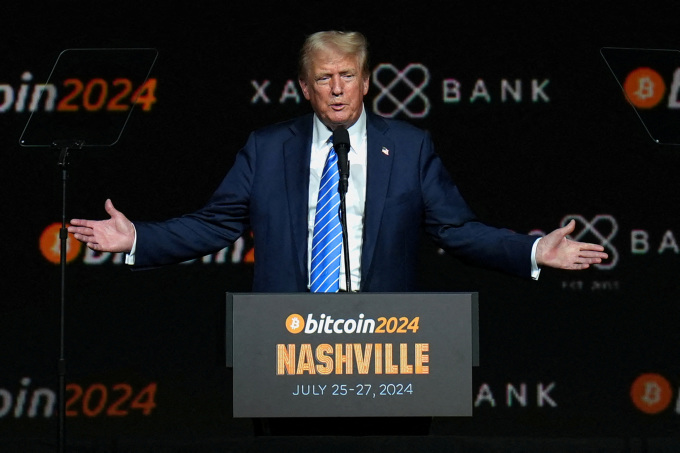

Trump’s victory is considered the main driving force for the new price increase. Forbes believes that this is not an unfounded belief when the cryptocurrency industry is the largest “sponsor” in this year’s election. A report by the progressive consumer advocacy group Public Citizen found that industry contributions accounted for 44% of the corporate group’s total as of August. The bulk of the money went to political action committees (PACs) that support pro-crypto candidates.

PACs funded largely by crypto companies like Coinbase and Ripple have spent a combined $135 million to support industry-friendly candidates in federal races, according to The New York Times. The investment appears to have paid off: as of November 10, 268 pro-crypto candidates had been elected to the House of Representatives and 19 to the Senate, according to the nonprofit Stand With Crypto. That’s a far cry from the 122 newly elected House members and 12 senators who are considered “anti-crypto.”

President-elect Donald Trump campaigned on a promise to make the United States the “cryptocurrency capital of the planet.” Many of his pledges to the crypto community include launching a national cryptocurrency reserve with more than $16 billion in Bitcoin that the U.S. government has amassed through asset seizures.

Trump’s pro-crypto stance marks a departure from his previous skepticism of the industry, which he has called a “scam.” Trump has repeatedly said he would “fire” SEC Chairman Gary Gensler for taking more than 100 regulatory actions against cryptocurrencies during his tenure, according to CNBC. The new president has also received support from crypto leaders such as billionaires Marc Andreessen, Cameron Winklevoss and Tyler Winklevoss. Vice President-elect JD Vance, meanwhile, is a longtime Bitcoin investor.

Trump and his campaign have personally invested in digital currencies, with the Trump joint fundraising committee starting accepting donations through Coinbase in May. He launched his own family crypto platform, World Liberty Financial, in September.

Donald Trump’s victory has also brought strong momentum to this market. According to statistics from one of the world’s most popular derivatives exchanges, Deribit, there has been more than $2.8 billion in capital betting on Bitcoin surpassing $90,000, i.e. placing call options. In addition, the CME derivatives exchange, which specializes in providing popular BTC futures contracts to institutional investors in the US, is betting on Bitcoin’s future price increase. This creates a very positive crowd psychology base that is spreading throughout the market.

From a technical perspective, the CoinDesk analysis team also pointed out a number of reasons why Bitcoin’s price increase is reasonable. They used inflation data from the US Bureau of Labor Statistics to measure how much purchasing power Bitcoin has lost compared to previous years. The result is that the current price has only increased by the same rate as the depreciation. BTC’s November 2021 record of about $69,000 has slid to $78,000 in nearly three years. This means that the current level is only about 4.5% higher than inflation.

In addition, CoinDesk has also tracked profit-taking over the past few weeks. Glassnode data shows that on November 6, the day after the US election, investors took profits of about $3.5 billion, and in the next two days, this figure was $3.2 billion.

However, this profit-taking is very small compared to the period in March when BTC surpassed the 2021 record. At that time, profit-taking activity skyrocketed to $10 billion. During the 2021 bull run, it also recorded a profit-taking level of $6 billion. The current profit-taking level is even lower than in 2017 – when Bitcoin was around $20,000. This shows that investors are still patiently waiting for higher prices.

In addition, CoinDesk also pointed out that public interest in BTC is currently relatively low. Google searches for the world’s largest cryptocurrency are still lower than in November 2021 and March this year. This partly shows that the market is still far from reaching extreme excitement.