Coincheck was once famous for its $530 million hack in early 2018, before being acquired by Monex Group.

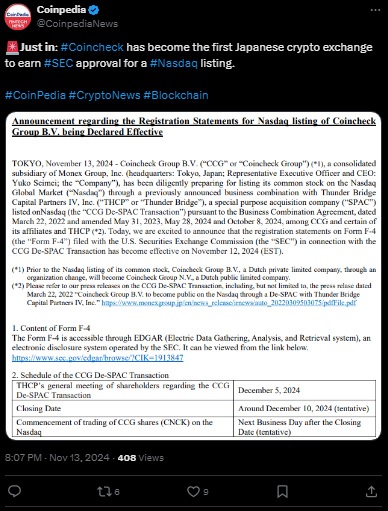

The US Securities and Exchange Commission (SEC) on November 12 approved Coincheck’s application to list shares on the Nasdaq Global Market in early December. Thus, Coincheck will become the first foreign crypto trading platform to be listed on the US stock exchange, with the code CNCK.

It is known that Coincheck has conducted a SPAC merger with Thunder Bridge Capital Partners to meet the listing conditions, with majority ownership still belonging to the parent corporation Monex Group.

Thunder Bridge Capital Partners will next hold a shareholder meeting on December 5 to complete the merger process so that Coincheck shares can be listed on Nasdaq as early as December 10.

According to data from CoinGecko, Coincheck has a 24-hour volume of $347 million, listing only major coins such as BTC, ETH, XRP, ETC, BCH, NEM, and a few other smaller altcoins.

The exchange is perhaps best known for its hack in early 2018, which resulted in a record loss of more than 500 million NEM, worth $530 million at the time.

In the US, there is currently only one publicly traded cryptocurrency exchange, Coinbase with the stock symbol COIN. Coincheck’s SEC approval to list on the US stock exchange could pave the way for many other crypto companies both in and outside the US to do the same.