Cryptocurrency Arbitrage Trading is a strategy that takes advantage of the price differences of the same Cryptocurrency on different exchanges.

Cryptocurrency Arbitrage Trading involves buying a Cryptocurrency on one exchange at a certain price and selling it on another exchange at a higher price. This price difference, known as the spread, can be profitable. This can be a viable alternative to traditional Cryptocurrency trading in many cases, if you understand the basics.

The process is similar to buying low and selling high in the traditional stock market — except you are profiting from the price differences on different exchanges instead of waiting for the stock price to fluctuate.

The Cryptocurrency market is decentralized and operates 24/7, compared to traditional stock markets which are often limited by regulations and are only open during certain hours. As a result, the value of Cryptocurrencies can fluctuate across exchanges due to differences in liquidity, local demand, and data sources. For example, the liquidity of Bitcoin (BTC) on one exchange and local demand can affect the price of BTC on different exchanges.

While the price difference may be small, frequent trades can accumulate significant profits, especially when using automated systems.

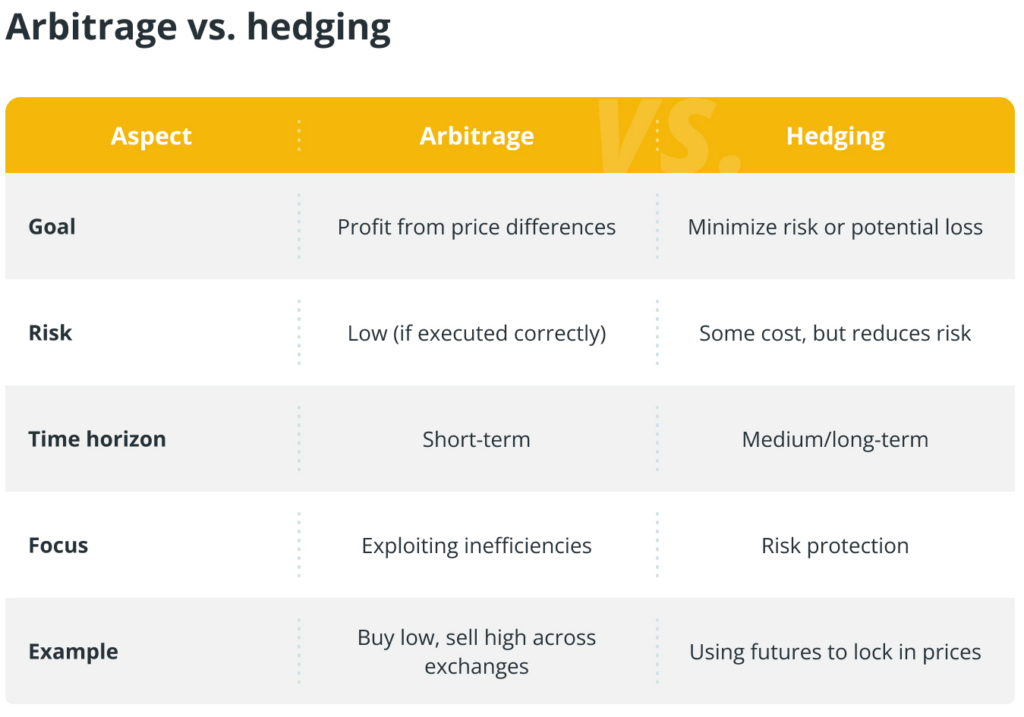

However, note that arbitrage is not the same as scalping. Arbitrage seeks to profit from price differences in different markets, while scalping aims to reduce risk by offsetting potential losses.

Here is a summary of the differences between the two concepts:

How Cryptocurrency Arbitrage Works

Arbitrage involves buying a Cryptocurrency on an exchange with a lower price and selling it on an exchange with a higher price.

For example, if Bitcoin is listed at $85,250 on exchange A and $85,300 on exchange B, you can buy Bitcoin from exchange A, transfer it to exchange B, and sell it for a profit. Of course, there are external factors to consider, such as transaction fees and wallet transfer times, but we’ll discuss those later.

However, it’s important to act quickly when you spot an arbitrage opportunity, as price volatility can prevent a profitable trade from being made. Speed matters.

Despite some challenges, arbitrage is generally considered a lower-risk trading strategy than other speculative methods. It focuses on small, frequent profits rather than risky investments with large stakes.

Did you know? While it may seem like a legal gray area, there’s nothing illegal about arbitrage trading. In fact, some argue that this process helps the market maintain healthy price fluctuations.

Benefits and Risks of Cryptocurrency Arbitrage

The benefits of arbitrage are low risk due to small spreads and the ability to make money in all market conditions, while the risks are related to market volatility, hidden fees, and the reliability of the exchanges.

Benefits of Cryptocurrency Arbitrage

Low Risk: Due to small price differences, arbitrage is a low-risk activity compared to regular trading.

Profits are independent of market conditions: This approach allows you to arbitrage regardless of the state of the market. Whether Bitcoin is $15K or $80K, with a $50 spread, you can focus on the spread rather than the overall trend.

Risks of Cryptocurrency Arbitrage Trading

Market Volatility: While market volatility is less of a factor when it comes to arbitrage trading, the unpredictability can still cause losses if you are not careful.

Hidden Fees: Transaction and exchange fees, speed, and other costs can reduce your profits if you are not prepared. Make sure you are aware of all the fees you will be charged when arbitrage trading.

Exchange Reliability: Using unregulated or unreliable platforms or exchanges increases your risk of losing your capital. Always prioritize platforms that are safe and well-established.

Arbitrage trading has been around for centuries. When the gold standard was in place, traders took advantage of the difference in international gold prices to buy gold in one country and resell it in another for a profit.

Cryptocurrency Arbitrage Trading Strategies

The three main types of Cryptocurrency Arbitrage trading strategies include simple arbitrage (following price differences across exchanges), triangular arbitrage (exploiting price gaps within a single exchange’s trading set), and cross-border arbitrage (taking advantage of regional price variations across international platforms).

Simple Arbitrage

This simple approach involves tracking price differences between exchanges. For example, if Bitcoin is $200 cheaper on Exchange A than on Exchange B, you would buy on Exchange A and sell on Exchange B to make a profit.

Triangular Arbitrage

This method exploits price differences within an exchange by trading between three Cryptocurrency pairs. For example, you could trade BTC for Solana (SOL), exchange SOL for Dogecoin (DOGE), and finally convert DOGE back to BTC. Triangular arbitrage avoids inter-exchange fees, making it a cost-effective option.

Cross-border arbitrage

Cross-border arbitrage is similar to simple arbitrage but involves trading across international exchanges. However, different regulations and local demands can affect prices globally, and paying attention to these arbitrage differences can be profitable.

Keep in mind that this method requires exchange accounts in multiple countries, which can be difficult depending on your local laws.

Mt. Gox, the world’s first Bitcoin exchange, is an early example of arbitrage. It listed Bitcoin prices at hundreds of dollars more than other exchanges, creating an ideal environment for early traders to arbitrage. Unfortunately, the platform has suffered a lot of bad press and still struggles to pay its users 10 years later.

Cryptocurrency Arbitrage Tools

Automated trading bots make the arbitrage process smoother by analyzing exchange price data and executing API trades quickly, although proper configuration is important for effective risk management.

While you can always execute arbitrage trades manually across multiple exchanges, automated Cryptocurrency trading bots can also be set up to process data faster.

For example, bots can collect price data from multiple exchanges in real time and execute trades across platforms via the exchange’s application programming interface (API).

Just remember that bot automation requires some effort and time to do properly — an important part of risk management in Cryptocurrency trading. You can create an automated bot or rent pre-built bots from reputable sources. Either way, bots are a great tool to try and generate arbitrage profits from Cryptocurrencies.

Additionally, arbitrage alert tools can monitor prices for you and send you alerts when opportunities arise. They make it easy to spot opportunities without having to constantly check prices. Similarly, platforms like CoinMarketCap and CoinGecko allow you to view Cryptocurrencies prices from multiple exchanges in one place. They can help you quickly spot price discrepancies and find arbitrage opportunities.

Finally, blockchain explorers and analytics tools can give you insights into trading data and market liquidity. They help you see the big picture and find arbitrage opportunities based on onchain activity.