The bull is a statue that has long been a symbol of Wall Street – the historic heart of New York’s financial district. The alternation between bull and bear markets is common in traditional stock markets. So, how do you know when a bull or bear market will appear?

For the cryptocurrency market, this concept is of particular importance due to the specificity of the field. Understanding the characteristics of bull and bear markets in cryptocurrency will help you overcome recessionary periods and maximize profits when the market booms.

Origin of the terms Bull and Bear Market

A bull market is usually a market in which prices have increased for a significant period of time. At the same time, a bear market is characterized by a prolonged period of decline.

There are several versions of bull and bear markets in the stock market, and according to one of them, the names of bull and bear markets come from the way these animals attack.

Bulls lift their victims up with their horns, so a bull market is a rising market. Meanwhile, bears attack from above, thus symbolizing a fall in prices.

According to another version, American bearskins traders often signed pre-purchase agreements. So when they bought them from hunters, they tried to lower the purchase price to make more profit.

Bulls and bears in financial markets

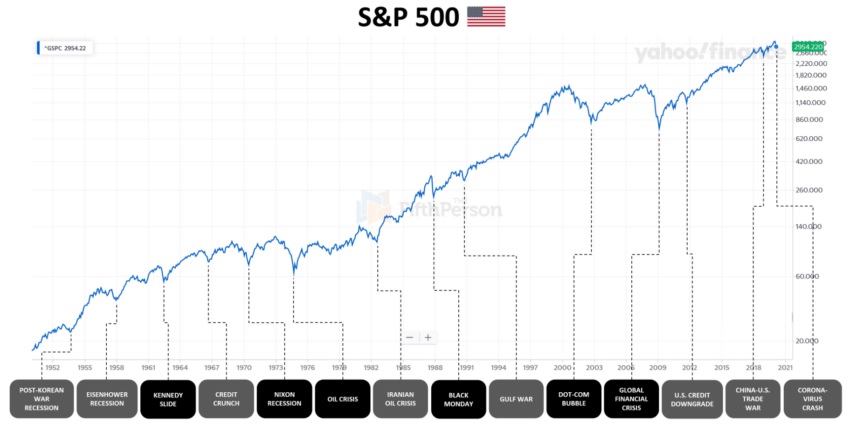

In traditional stock markets, a long bull market is suddenly replaced by a bear market. Usually, this happens before a major negative event in the economy or other sectors. For example, the 2008 bear market began after the bankruptcy of one of the largest banks in the United States, Lehman Brothers.

Before 2008, bear markets were triggered by the Dot.com bubble – when overvalued Internet company stocks began to decline. Pandemics, such as Covid-19, or large-scale wars, such as Russia’s invasion of Ukraine, can trigger bear markets.

Bear markets and bull markets can vary in length over time. For example, the bear market caused by Covid-19 lasted about a month from late February to late March 2020. After that, it immediately turned bullish. At the same time, the bear market in the context of the Nixon economic crisis in the United States lasted almost a year (from 1972 to 1973). The state of the economies of the most developed countries in the world is often a good indicator of financial market trends.

Although the causes of bear and bull markets are easy to explain after the fact, predicting them is very difficult. The cause is human factors. It is unclear at what exact moment supply will exceed demand in the market and cause the first wave of declines.

Bulls and bears in the cryptocurrency market

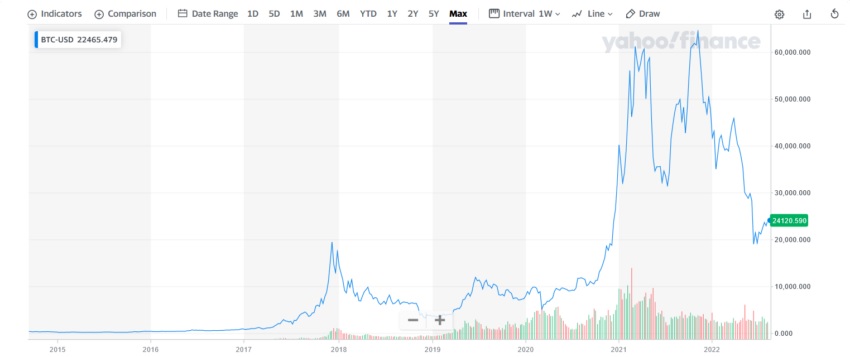

The cryptocurrency market is quite young, about 14 years old if we take the publication of the Bitcoin whitepaper in 2008 as a reference point.

Sometimes traders’ lack of understanding of the nature of cryptocurrencies will exacerbate the volatility and instability of the market. It often follows a similar trend to the stock market in terms of when a bear market is replaced by a bull market. The main difference is the depth of the decline and the height of the growth momentum.

Take the bear market of 2022 as an example. The bear market in crypto started in November 2021 and continues to this day, while the stock market started a few months later – in January 2022.

From its peak in February 2022 to its low in June 2022, the S&P 500 fell from 4,504 to 3,667, or -18.6%. At the same time, Bitcoin plunged from its peak of $69,000 to $19,018 (-56.7%).

It is important to note that we are comparing stablecoins to an index of 500 companies. If we were to compare them to other cryptocurrencies and assets, the differences would be more pronounced.

Such fluctuations in the cryptocurrency market can be observed frequently since 2017, when various coins and tokens began to gain popularity. Since then, the cryptocurrency bull and bear markets have become more pronounced.

How to survive in bull and bear markets?

Investing is always associated with risks. Investing in the stock market is considered one of the riskiest ways to invest. And the cryptocurrency market has a higher level of risk due to its higher volatility during periods of decline and increase. The investment strategy depends on the goals, capabilities and risk tolerance of each investor. At the same time, you should limit the risk by investing part of your money in different assets.

Same with eggs: you should never put all your eggs in one basket, because if one falls, all the eggs will break. The same philosophy should apply to investments – it is necessary to invest in different assets. The basic rule is: the greater the risk, the smaller the investment amount.

For example, only 10% of the total investment amount can be invested in stocks and 5% in cryptocurrencies. Other funds are better spent on fixed guaranteed income instruments such as bonds.

This approach makes it easier to go through a bear market. If you have only a small amount of money in cryptocurrencies, then it is unreasonable to sell it in a bear market. It is better to wait for the change to a bull market and then take profits.

It is important to be patient and not make hasty decisions. By the way, buying in a bear market, when everyone is panicking and selling, is considered a trading skill.