Cryptocurrency exchange Binance is preparing to launch a new stablecoin called BFUSD, which will be used exclusively as collateral for futures trading, but will stand out for its high interest rate.

According to information posted on the Binance website, the world’s largest cryptocurrency exchange has launched a new crypto coin called BFUSD, with a holding interest rate (APY) of up to 19.55%.

Although there are no specific details about BFUSD yet, based on the Binance website, the new coin will be a stablecoin backed by USDT. Binance users can convert between the two assets directly through the exchange, with limits depending on the VIP level of their account.

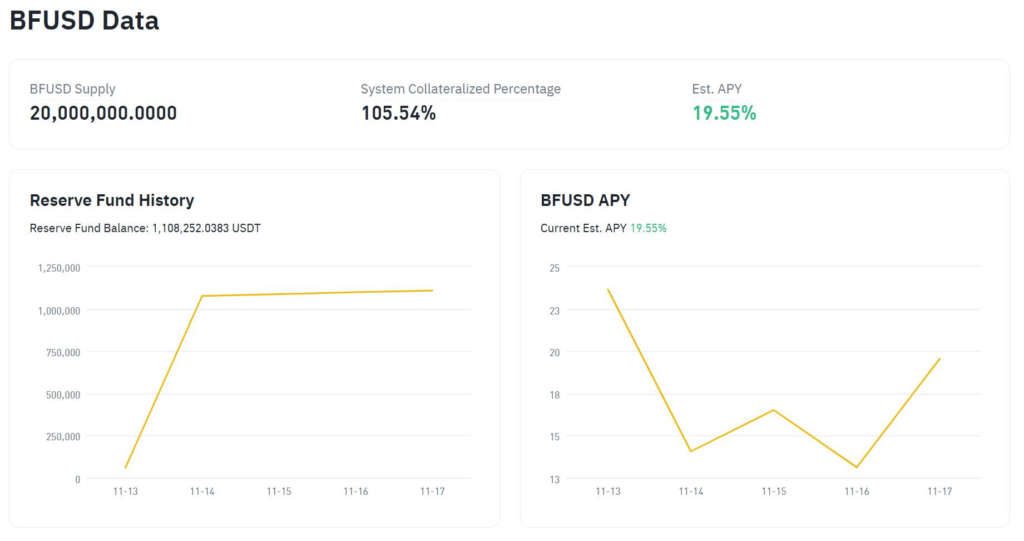

BFUSD currently has a total supply of 20 million tokens, with a reserve fund of 1.1 million USDT.

BFUSD will only be limited to trading on the Binance Futures platform, used as collateral in Multi-Assets mode through “UM Wallet”. In particular, the exchange will also have a BFUSD-based reward mechanism for users based on daily trading activities.

The exchange website also claims that users who own BFUSD will not need to stake or lock assets to trade futures, BFUSD can be collateralized at a rate of up to 100%, as well as pay a higher APY than many other stablecoins on the market.

The APY Binance offers to BFUSD holders is currently 19.55%, but it is still unclear how the exchange can generate such a large profit for investors. Therefore, many people have begun to compare the exchange’s new product with previous failed high-interest-paying stablecoin models such as Terra’s UST (LUNA).

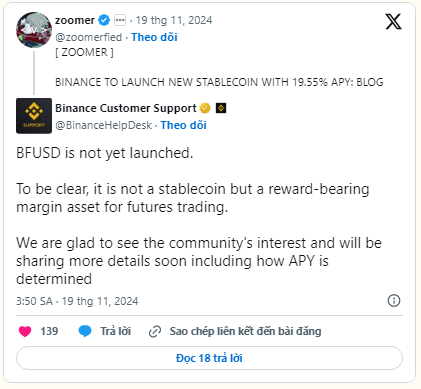

A Binance representative later issued a statement saying that BFUSD has not been officially deployed yet, and at the same time rejected the “stablecoin” title being placed on this coin, instead describing it as “a collateral asset that generates rewards for futures trading”. The exchange also pledged to provide more information on how interest is calculated to the community.

This is Binance’s latest stablecoin launch since BUSD was forced to stop by the US government in 2023, forcing the exchange to switch to TUSD and then FDUSD.