US Bitcoin ETFs were allowed to trade options on November 19, giving BTC a new boost.

Nasdaq on November 19 began trading options on shares of US Bitcoin ETFs.

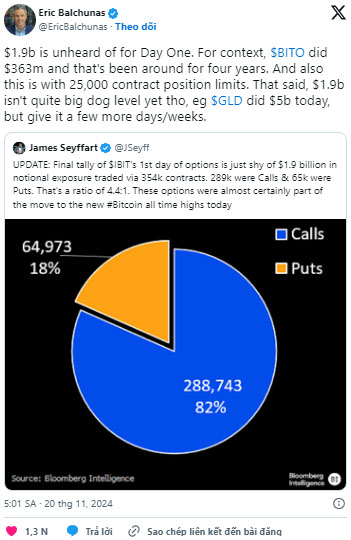

The impact of this news on the Bitcoin market was immediate, as in the first trading session, BlackRock’s IBIT fund recorded $1.9 billion in options trading volume, according to data from Bloomberg.

The ratio of call options was 4.4 times higher than put options, showing that Wall Street investors’ demand for more Bitcoin is still very high.

Bloomberg expert Eric Balchunas commented that the $1.9 billion achievement is a record number in the group of financial products for cryptocurrencies, although it is still nothing compared to options for traditional fund stocks.

Bitcoin price in the early morning of November 20 had a moment when it skyrocketed to $93,900, the next record high that the world’s largest cryptocurrency reached in this historic November. However, BTC price in the following hours was adjusted to the $91,900 area.

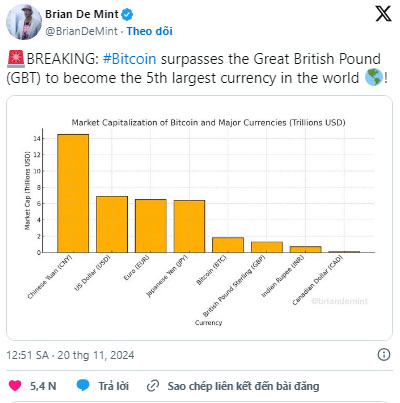

BTC’s capitalization in the morning of November 20 also increased to a new high of $1.86 trillion, accounting for 56.8% of the total capitalization of $3.27 trillion of the entire crypto market.

With the new capitalization, Bitcoin has surpassed the British pound to become the world’s 5th largest capitalized currency.

However, the current increase is still limited to BTC, with many other top altcoins still showing no signs of breaking out with the “big brother” of the market.

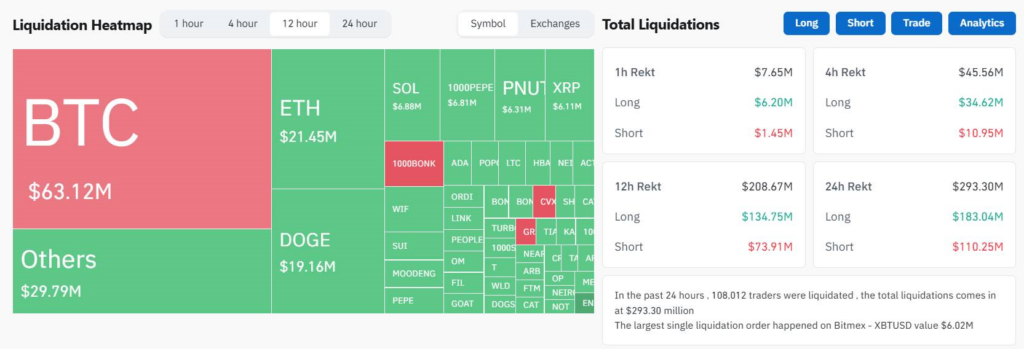

In the last 12 hours, there have been nearly $210 million in derivatives liquidations, with longs accounting for 64.5%.