Coinbase Will Discontinue Wrapped Bitcoin (WBTC) Trading in December 2024. WBTC is the largest tokenized version of Bitcoin (BTC) on Ethereum and other blockchains.

The largest US cryptocurrency exchange Coinbase will discontinue Wrapped Bitcoin (WBTC) trading on December 19, 2024. Coinbase determined that WBTC no longer meets its listing criteria on its platform.

Coinbase has now suspended market trading for WBTC, supporting only limit orders. Users can still access and withdraw WBTC at any time after trading is suspended.

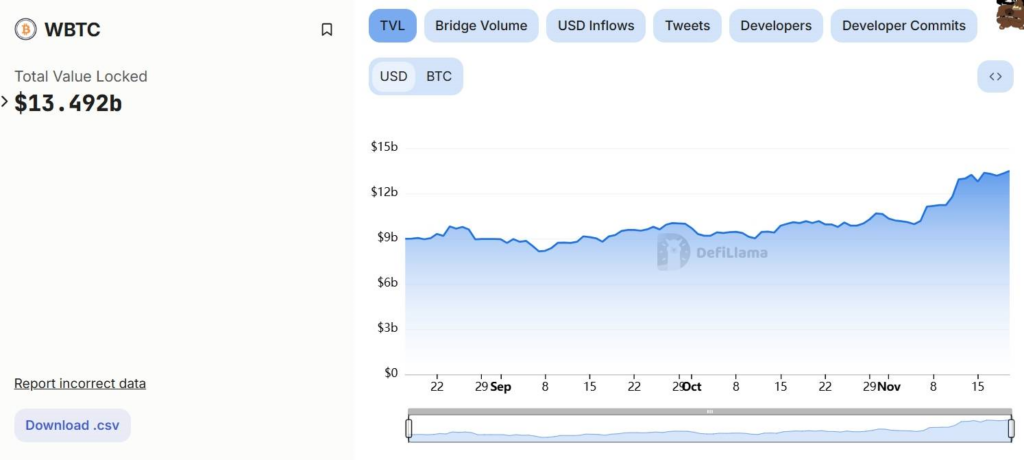

WBTC, managed by BitGo, represents Bitcoin on other blockchains and is often used as collateral in DeFi. According to data from DefiLlama, WBTC remains the most popular wrapped Bitcoin with $13.4 billion in value locked (TVL).

However, in August 2024, BitGo transferred part of the control of the multisignature wallet containing Bitcoin backed by WBTC to BiT Global in Hong Kong, which is closely related to Justin Sun. This incident raised concerns in the community, as the TRON founder had arbitrarily withdrawn $720 million in Bitcoin backed by USDD.

Wrapped BTC expressed disappointment and surprise at Coinbase’s decision, while emphasizing its commitment to providing compliant, transparent, and decentralized Bitcoin crypto products. They wanted Coinbase to reconsider its decision to delist WBTC. However, not only Coinbase, Sky (Maker DAO) also decided to “isolate” WBTC, with the same concerns as Justin Sun.

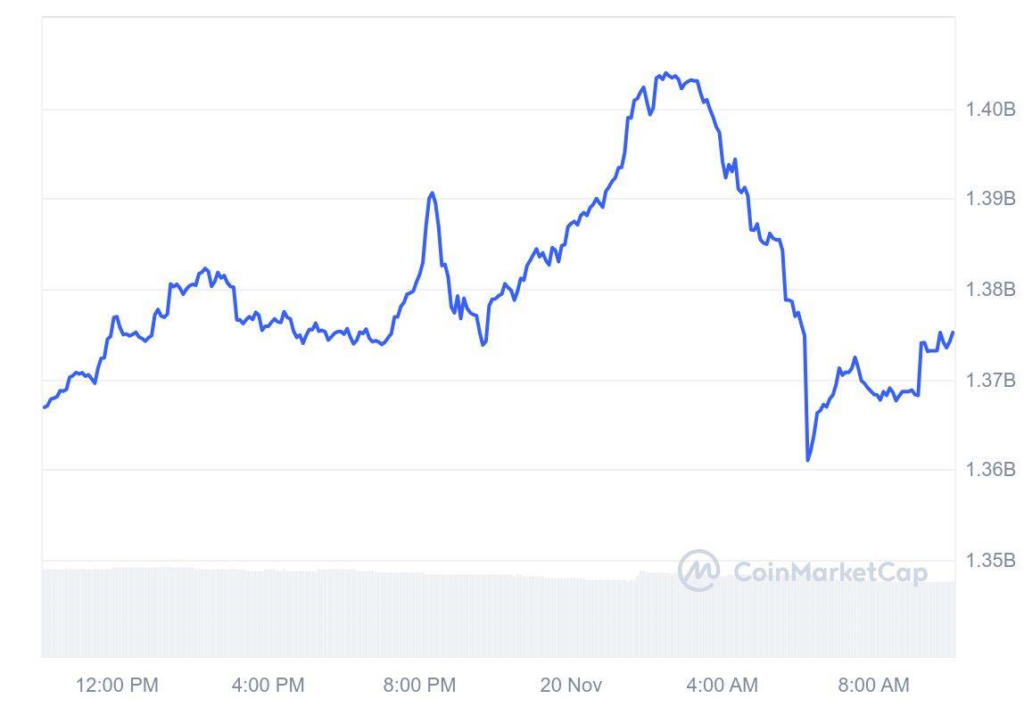

The above event took place in the context of Coinbase launching a competing product Coinbase Wrapped BTC (cbBTC) on September 12. In just a few months, cbBTC has quickly become one of the largest Bitcoin wrappers with $1.4 billion in TVL, according to CoinMarketCap.

However, Coinbase has also faced criticism for being perceived as less transparent than its competitors in the space. Some unfounded rumors have even suggested that Coinbase has issued unbacked IOUs in Bitcoin to BlackRock, a cryptocurrency ETF issuer. In response, Coinbase has promised to add verifiable proof of reserves to cbBTC soon.

Coinbase’s removal of WBTC not only marks a major shift in the exchange’s strategy, but also reflects the fierce competition in the Bitcoin wrapper space. While WBTC remains the leader, Coinbase is working to promote cbBTC by increasing transparency and building trust from the community.