Michaël van de Poppe, a prominent crypto analyst, recently shared on X that Bitcoin hitting $100,000 is just the beginning of a major cycle of money flowing into altcoins.

He compared the current cycle to the 2017 crypto cycle, when many new investors entered the market. Van de Poppe highlighted the concept of a “rotation game,” in which Bitcoin leads the market, followed by Ethereum, and finally altcoins.

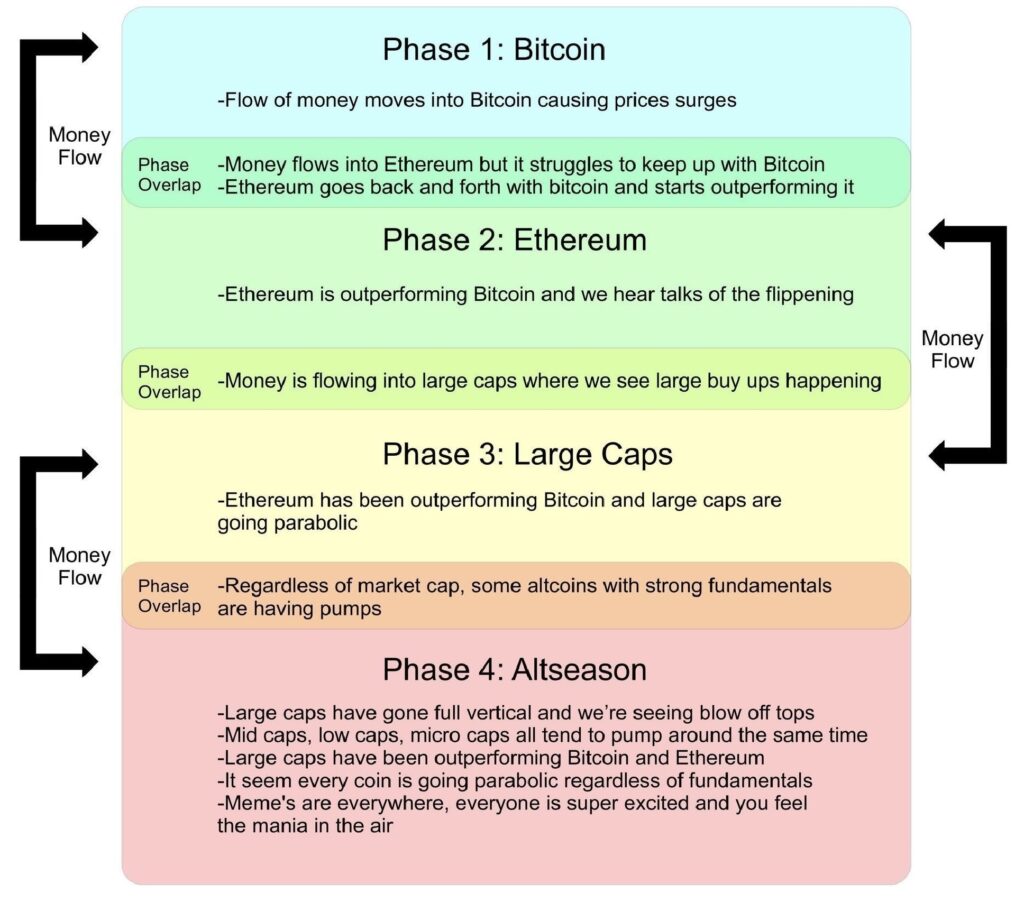

Here is an overview of Van de Poppe’s “rotation game,” which aligns with the four phases of market movement in the crypto ecosystem:

Bitcoin Phase

Bitcoin typically leads the market, with an increase in value as money flows into Bitcoin first. This is the beginning of the cycle when investors gain confidence, pushing up the price of Bitcoin. However, as Bitcoin surges, Ethereum may struggle to keep up, although Ethereum will eventually catch up and surpass Bitcoin.

Ethereum Phase

In Phase 2, Ethereum begins to outperform Bitcoin, and many analysts begin to talk about the possibility of Ethereum surpassing Bitcoin in terms of market capitalization. This is when money begins to flow into large-cap assets, especially projects within the Ethereum ecosystem.

Van de Poppe points out that Ethereum’s outperformance signals the beginning of a strong altcoin bull run. As Ethereum strengthens, large-cap altcoins also begin to see explosive growth, offering great profit opportunities.

Large-Cap Altcoins

During this phase, Ethereum continues to outperform Bitcoin, and large-cap altcoins begin to see parabolic growth. This is the time when investors turn their attention to altcoins with higher risk and greater profit potential. Van de Poppe believes that this is an important time for investors to focus on high-risk assets in the Ethereum ecosystem, especially large-cap altcoins.

Altseason

In the final stage, large-cap altcoins will peak and the market will become filled with excitement. This is when Altseason or Altcoin Season occurs – mid-cap, low-cap, and micro-cap altcoins will start to grow in unison. Memecoins will also explode, and the market will be filled with excitement.

Van de Poppe’s investment strategy is to use Ethereum as a base pair, as he believes Ethereum will outperform Bitcoin in the next 6 to 12 months. He recommends investing in small altcoins in the Ethereum ecosystem to maximize profits. As small altcoins start to rally, it is important to move money back into assets like Bitcoin and Ethereum to lock in profits.

In summary, Van de Poppe’s analysis provides a roadmap for investors who understand the rotation game, focusing on moving money from Bitcoin to Ethereum, then large and small cap altcoins as the market progresses through the phases.

Now that we are in Phase 2, with Ethereum outperforming Bitcoin, it is a promising time for those who are invested in Ethereum and large cap altcoins. The next step would be to observe the movement of small cap altcoins and make appropriate adjustments in the portfolio.