On Monday, Ethereum spot ETFs recorded their largest net inflows in history with $295.5 million, more than doubling the previous record of $106 million on their first day of launch.

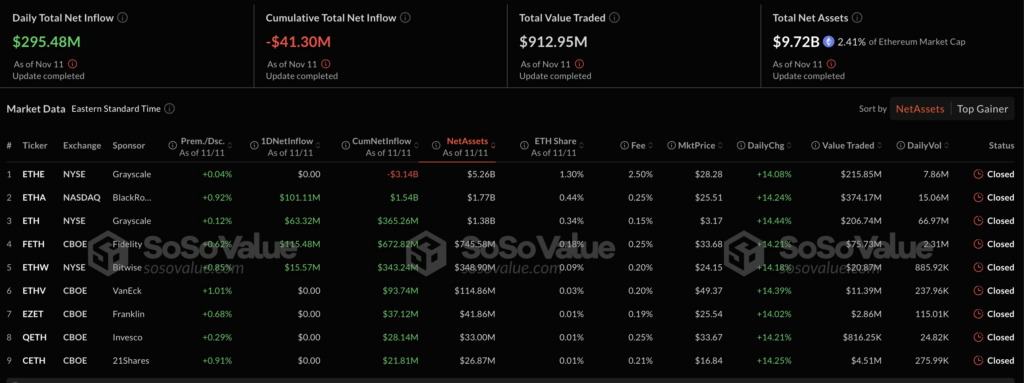

The inflows were led by Fidelity’s Ether ETF, which saw $115.5 million, according to data from SoSoValue. BlackRock’s ETHA ETF followed with $101.1 million, Grayscale Mini Ethereum Trust attracted $63.3 million, and Bitwise’s ETHW recorded $15.6 million in inflows.

In the four trading days following Donald Trump’s presidential election victory, Ethereum spot ETFs accumulated a total of $513 million in net inflows.

Surge in Trading Volumes and Investor Confidence

Also on Monday, spot Ethereum ETFs traded a record $912.9 million, surpassing Friday’s $469.1 million and well above the typical $100 million to $200 million range.

“The prospect of a more flexible regulatory framework has eased investor concerns, opening the door to a more favorable environment for Ethereum and DeFi assets,” said Rachael Lucas, an analyst at BTCMarkets. If this positive sentiment continues, inflows into Ethereum ETFs are likely to continue to increase as institutional investors prepare for upcoming regulatory changes.

DeFi Growth Boosts Ethereum Confidence

Ms. Lucas also said that the strong recovery of DeFi tokens such as Aave, Uniswap, and Lido shows the market’s growing confidence in the Ethereum ecosystem. “If the growth trend of DeFi tokens continues, this will likely drive interest and inflows into Ethereum ETFs, as they provide an indirect channel to access the entire DeFi market,” she said.

Currently, the total net assets of the nine Ethereum ETFs have reached $9.7 billion, accounting for about 2.4% of the total Ethereum market capitalization. However, these funds still recorded negative net inflows of $41.3 million.

Bitcoin ETFs Attract $1 Billion inflows

Meanwhile, spot Bitcoin ETFs also saw strong net inflows, reaching $1.1 billion on Monday, marking the second time inflows exceeded $1 billion, following $1.38 billion on November 7.

BlackRock’s IBIT ETF led the way with $756.5 million, followed by $135 million in Fidelity’s FBTC ETF and $108.6 million in Ark and 21Shares’ ARKB ETF. Five other ETFs also saw positive inflows on Monday.

Trading volume for 12 Bitcoin ETFs reached $7.3 billion, the highest since March 14. Total net inflows for these funds now total $26.9 billion.