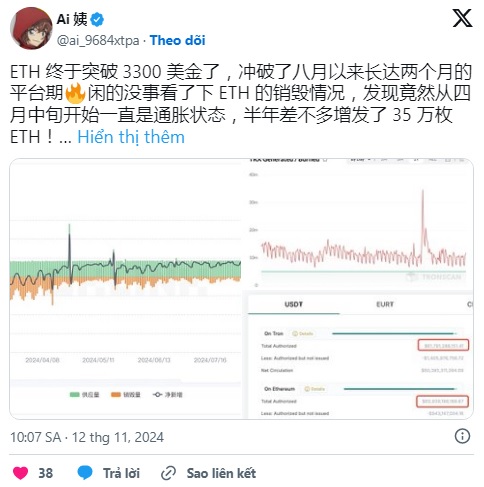

According to analyst @ai_9684xtpa, Ethereum has been experiencing inflation since mid-April, with over 350,000 ETH issued in the past six months. The surge in new ETH supply has sparked discussions about its impact on Ethereum’s economic future, especially as the ETH burn rate has been slowing down.

Ethereum Inflation: 350,000 ETH Issued in Six Months

Although the amount of new ETH issued in the past six months has increased significantly, it is still far below the inflation peak in March of this year, when the amount of ETH burned on the network reached a record high. At that time, this deflation combined with Bitcoin’s all-time high (ATH) price created strong demand for ETH, contributing to its value. However, from April onwards, the amount of ETH burned via the EIP-1559 mechanism began to decrease, leading to an increase in the overall supply of Ethereum.

The ETH burn rate increased in August, fueled by the hype surrounding Memecoin and strong trading activity in the market. This increased transaction fees, which in turn boosted the Ethereum burn rate. However, the impact of Memecoin quickly faded as the trend cooled, causing the burn rate to decrease and putting continued inflationary pressure on ETH.

The Challenge of Maintaining ETH’s Value

The inflationary pressure has raised questions about whether Ethereum can maintain its value and scarcity in the future. Some analysts warn that if inflation continues, the value of ETH could be negatively affected. Maintaining a balance between ETH issuance and burning will continue to be a key factor in determining Ethereum’s stability and economic future as the network continues to grow.

The delicate balance between supply and demand, coupled with mechanisms like EIP-1559, will be crucial for Ethereum to maintain its scarcity and value in the long term.