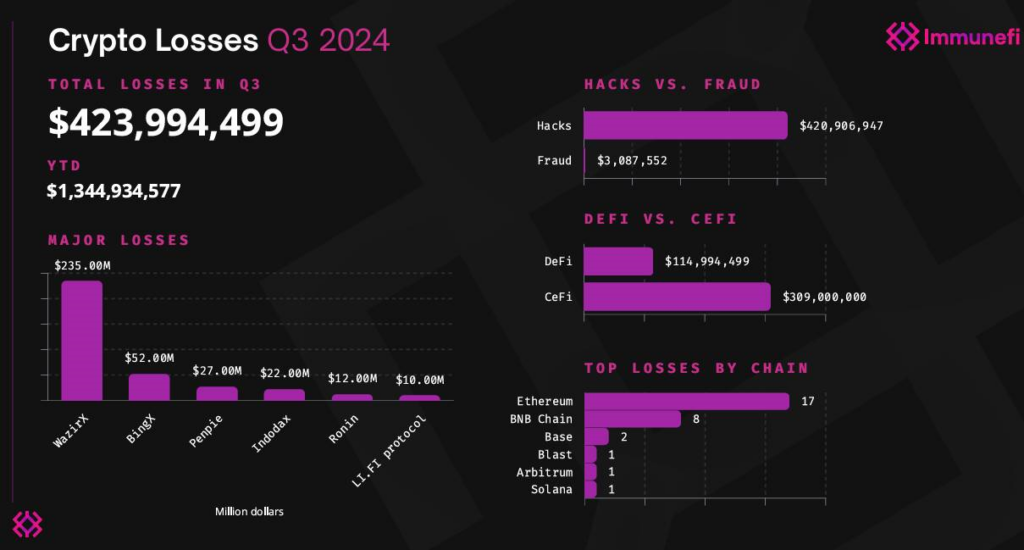

The crypto sector lost $423.9 million in Q3 2024 due to hacks and scams, down 38% from the same period in 2023, of which 45% of the total came from the WazirX exchange hacking service.

According to the latest report from the bug money platform Web3 security service Immunefi, the crypto sector in Q3 this year recorded more than $423.9 million in losses due to 34 attempted security attacks (hacks) and 3 scams (scams). Thereby, raising the number of hacks and scams in the year to 179, with the amount of losses recorded at $1.34 billion year-to-date.

The $423.9 million lost in Q3 2024 was largely attributed to the Indian crypto exchange WazirX, which saw a 45% hack with a $235 million failed exit.

BingX is second on the list, having been hacked during the $52 million recovery period in September 2024. Following BingX is the DeFi protocol Penpie, which was hacked for $27 million, creating a “deep” PNP token after the news. Next is the Ronin bridge with $12 million, the LI.FI bridge with $10 million, Bittensor (TAO) showing a private key with a shortened address of $8 million in assets, and three other names: RHO Markets, Casper Network, Delta Prime.

While the $423.9 million recorded in Q3/2024 is a large number, compared to the same period last year, $685.9 million was down 38%, picking any positive part in the security of these protocols in the Web3 environment.

In October 2024 alone, the total loss from hacks and scams was $55.1 million, equivalent to a 56.6% decrease compared to the $126.9 million recorded in September. However, this is an increase of 114% compared to October 2023.

The loss in October was mainly from 7 incidents, but the majority of the loss came from two projects: the $50 million hack of DeFi protocol Radiant Capital and the $4.4 million mining of Tapioca DAO.

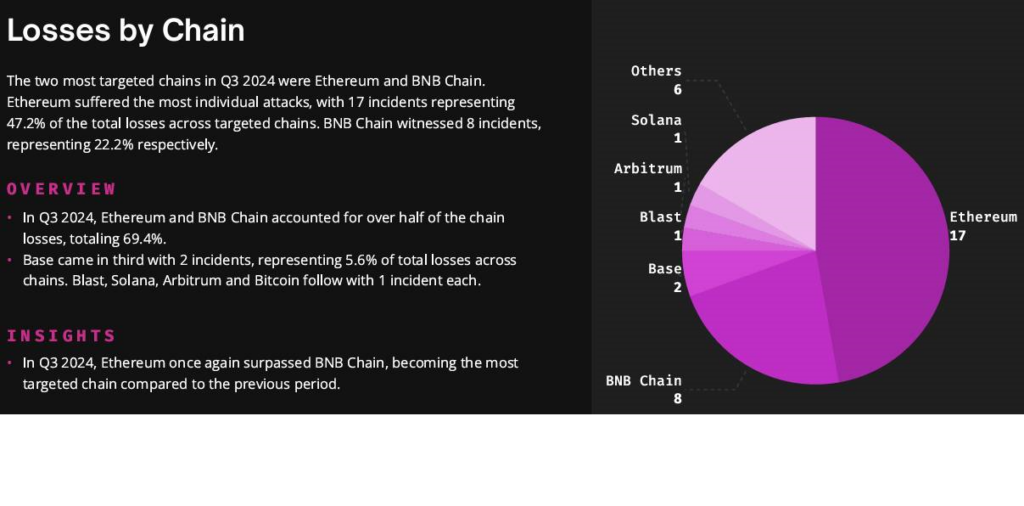

BNB Chain and Ethereum continued to be the two most targeted networks in Q3/2024, using up to 69.4% of the attacks. Notably, Ethereum had 17 targeted attacks, using a rate of 47.2%. While Base had 2 attacks with a rate of 5.6%, the remaining networks Blast, Arbitrum, Solana… only had 1 attack.

The above figure shows a change in hackers’ “interest” in attacking targets, when the report in Q2/2024 showed the results for BNB Chain.

At that time, Immunefi said that one of the main reasons for creating BNB Chain prone to disaster was because developers often used cloned source code (forked code). However, the total failure rate here has begun to decrease after important upgrades such as ZhangHeng, Plato and Hertz, which have solved many holes.