The head and shoulders pattern is a price pattern that signals a future reversal. Based on this pattern, investors can make buying and selling decisions more easily.

What is the head and shoulders pattern?

The head and shoulders pattern is a popular reversal pattern in the cryptocurrency market. It signals a reversal from an uptrend to a downtrend or vice versa. Investors need to pay attention when this pattern appears to place buy and sell orders in accordance with price movements.

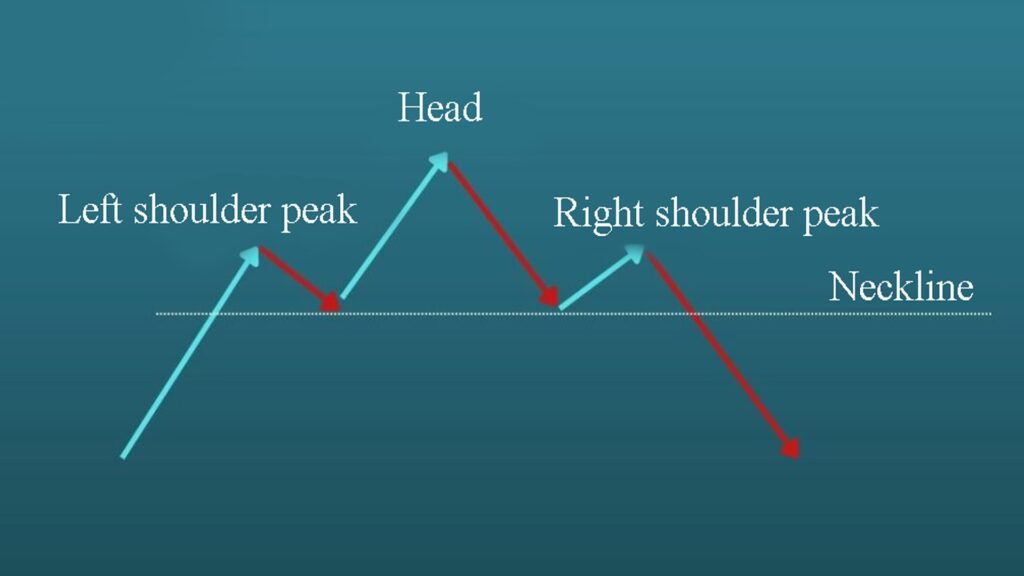

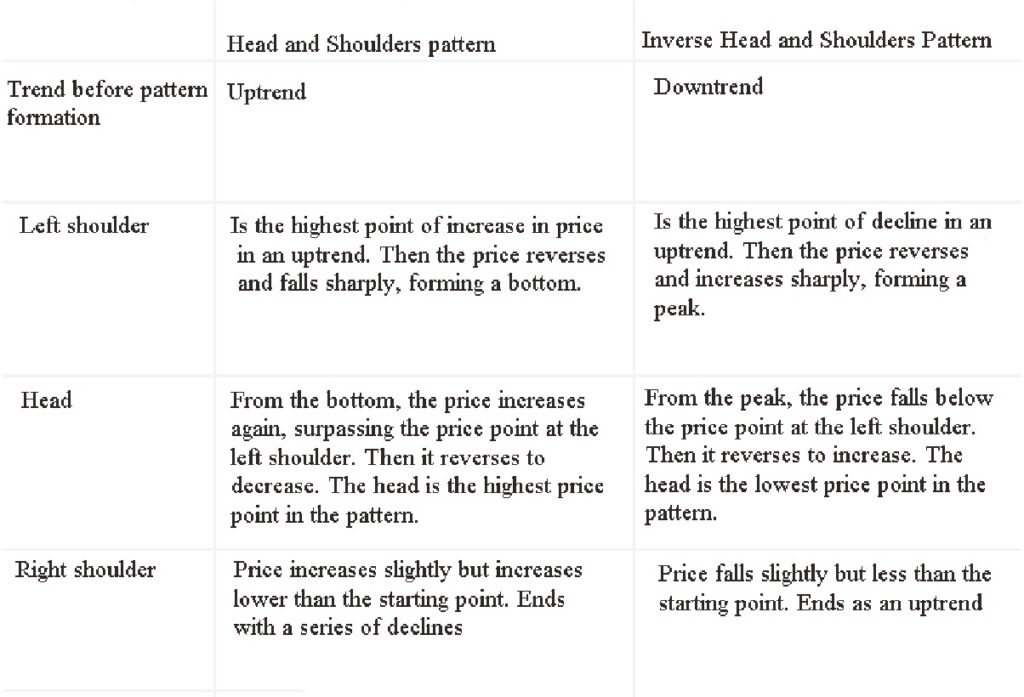

- Head and shoulders pattern

The head and shoulders pattern is a reversal pattern from an uptrend to a downtrend. This pattern contains three consecutive peaks with the highest head peak and two lower shoulder peaks, equal or nearly equal in height. The two shoulder peaks are connected by a neckline. The neckline can be horizontal, sloping up or sloping down depending on the situation. If the neckline slopes downward, meaning the right shoulder peak is lower than the left shoulder peak, it will have better trend prediction.

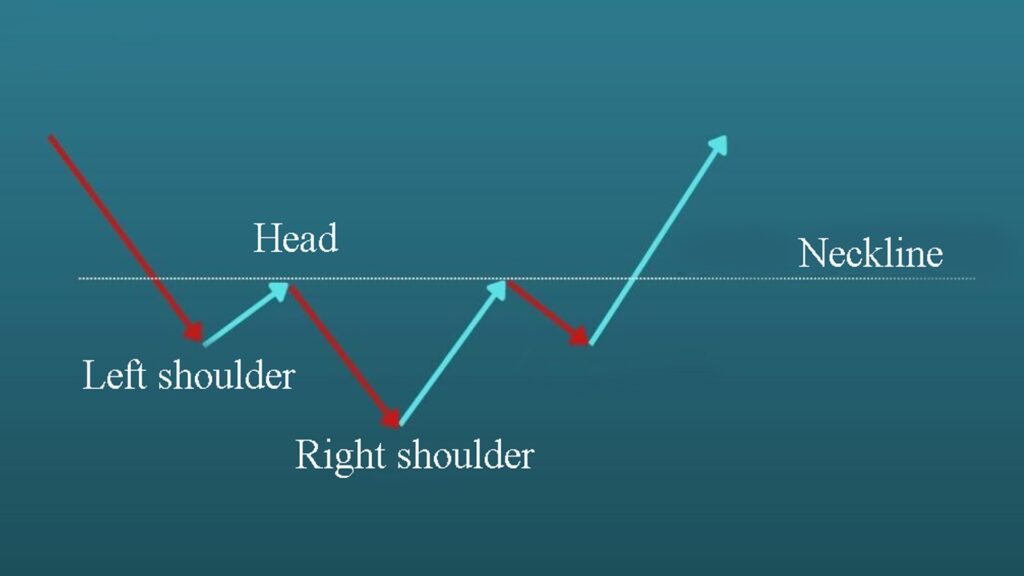

- Reverse pattern

On the contrary, the reverse pattern signals a reversal from a downtrend to an uptrend. This pattern consists of three consecutive bottoms with the Head bottom being the lowest and two higher shoulder bottoms. In other words, it is a 180-degree rotation of the head and shoulders pattern. You can visualize it through the illustration below.

Recognizing characteristics of the head and shoulders pattern

Note: This pattern is only confirmed when the resistance line Necline is broken. The price will decrease or increase beyond this resistance line. This is often the time when the pattern is most clearly confirmed.

Meaning of the pattern

The head and shoulders pattern is widely used in cryptocurrency trading as well as in stocks and forex. Investors can rely on the model to analyze and predict the market.

- Helps predict price fluctuations from up to down and vice versa. Depending on the positive or negative model, investors can evaluate the next price fluctuations.

- Helps optimize profits and minimize risks. Investors can determine the appropriate price target and stop loss range. Thanks to that, they have the most suitable buying and selling strategy.

How to trade with the head and shoulders model

The characteristic of this model is to signal a price reversal trend. Therefore, investors need to pay close attention when noticing the signs of the model to promptly trade to take profit or cut losses.

For the positive model, investors can consider selling virtual currency when the price falls below the Necline line. When the head and shoulders model appears, the price will reverse, so investors should consider placing a sell order to make a profit; or exit the order to limit losses. Especially when the price breaks the neckline, it predicts a very strong reversal.

On the contrary, with the reverse model, when the price increases and breaks the Necline, you can consider buying virtual currency. Because after breaking, the price trend is likely to continue to increase.

In addition, the Head and Shoulders model is also probabilistic like many other technical analysis models. The possibility that investors place a sell order and then the price increases again is possible. Therefore, you need to pay attention to the appropriate stop loss point and continue to monitor the market developments afterwards.

Conclusion

Hopefully, the above article has provided readers with knowledge about the Head and Shoulders model when trading in the virtual currency market. Thereby, I hope you can apply it to the investment process to choose the appropriate virtual currency buying and selling point to bring profit to the portfolio.