MicroStrategy (MSTR) has added more Bitcoin (BTC) to its portfolio, purchasing 51,780 tokens for $4.6 billion over the past week.

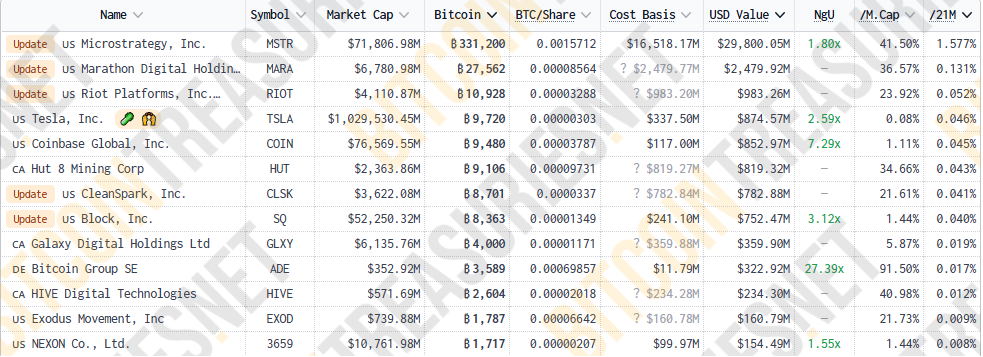

With this latest purchase, the company, which began buying Bitcoin in August 2020, now holds 331,200 BTC for a total cost of about $16.5 billion. At the current BTC price of around $90,000, the holding is worth nearly $30 billion.

To fund this latest purchase, MicroStrategy launched its at-market share offering, selling about 13.6 million shares for $4.6 billion. According to a statement released Monday morning, the company has about $15.3 billion more in shares it could sell under the current offering.

Over the weekend, Chairman Michael Saylor revealed details of the purchase.

Last week, the company announced that it had purchased 27,200 Bitcoin for $2 billion, bringing its purchases over the past few weeks to about 72,000 BTC for $6.6 billion.

MSTR shares fell 1% in premarket trading, but are still up nearly 400% year-to-date.

Marathon Digital Raises $700 Million in Convertible Bond Offering to Buy More Bitcoin

Marathon Digital Holdings (MARA) plans to raise $700 million through a private convertible bond offering, which it plans to use to buy Bitcoin and refinance debt, according to a press release on Monday.

The notes, which mature on March 1, 2030, will be unsecured and will bear interest semiannually beginning on March 1, 2025. The leading Bitcoin mining company intends to use approximately $200 million of the proceeds to redeem existing convertible notes maturing in 2026, with the remaining proceeds allocated to Bitcoin purchases and general corporate purposes.

The offering is aimed at qualified institutional investors pursuant to Rule 144A of the Securities Act of 1933. Marathon Digital will grant the initial purchasers a 13-day option to purchase up to an additional $105 million of the notes.

The notes will be convertible into cash, Marathon Digital common stock, or a combination of the two, at the company’s discretion, with interest payments semiannually. Final terms are being determined.

The offering follows similar moves by MicroStrategy and Japanese firm Metaplanet in their recent debt-backed Bitcoin buying strategies. MARA follows a similar “HODL” approach to MicroStrategy, holding all of its mined Bitcoin and planning to make ongoing purchases.

According to data from Bitcoin Treasuries, Marathon Digital is currently the top publicly listed mining company in terms of Bitcoin holdings, with a total of 27,562 Bitcoins. This puts Marathon Digital in second place in the Bitcoin ownership rankings, behind only MicroStrategy.