Ether (ETH) posted a strong 29% rally last week, surpassing the $3,000 mark for the first time since August. However, the rally has slowed down despite Bitcoin (BTC) gaining 13% in the past few days.

While Ethereum’s price has only increased by 0.66% since November 11, data suggests that whales are viewing the current price as an opportunity for long-term accumulation.

New Whale Buys $23.44 Million ETH

Throughout Q3, whale activity in the Ethereum ecosystem was very active as many wallets actively sold ETH to the market. With ETH’s price up 23% in Q4, a new whale address has emerged.

Lookonchain, an on-chain wallet tracking platform, reported on X that a new whale wallet has accumulated 7,389.5 ETH, equivalent to $23.44 million, in the past 24 hours.

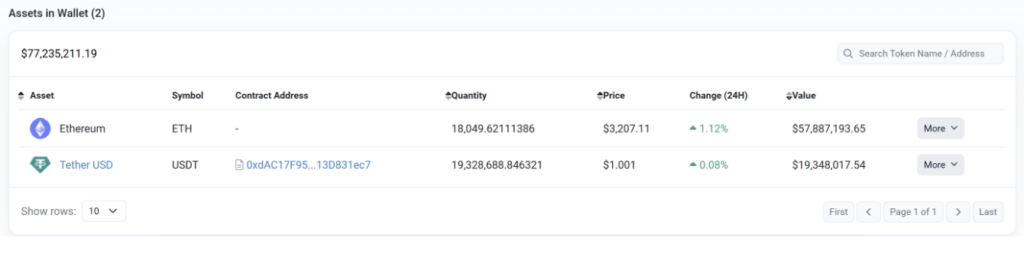

The wallet has been active since November 9, and has since purchased over 18,000 ETH at an average price of $3,201, currently worth $57.8 million.

It is worth noting that this wallet only holds Ethereum and $19.3 million in Tether (USDT). Therefore, if the ETH price drops to an attractive level, the whale may continue to accumulate more.

Some whale wallets have also traded large volumes of ETH in the past

Bitcoin Magazine previously reported that an ETH whale from 2016 cashed out over $30 million in profits from an initial investment of $38,000, representing an 80,000% return. This wallet moved 11,000 ETH in a single transaction when ETH was around $2,777.

Similarly, another ETH address that accumulated 23,743 ETH at an average price of $11 from August 2017 to November 2018 moved 6,250 ETH, or $20 million, to Kraken on November 14.

Ethereum ICO whales have a history of selling their ETH on Kraken based on past activity.

Ethereum faces strong resistance at $3,500

Despite Bitcoin’s price discovery this week, Ethereum has yet to surpass its previous all-time high (ATH) from 2021. As such, the altcoin continues to face strong resistance, especially when compared to its current ATH of $4,878.

Independent analyst Eddie said that ETH’s recent rally to $3,450 has precisely approached the 0.618 Fibonacci level from the ATH to the 2022 low. This Fibonacci level is also located in the supply zone between $3,550-$3,050.

He commented: “ETH faces strong resistance at the next key supply zone between $3,100-$3,500, which is expected to require more price action to overcome.”

Technically, Ethereum has closed the last two daily trading sessions with a bearish bias, and is now poised to retest the fair value gap (FVG) between $3,072 and $2,987 on the daily chart.

This price range includes an order book and support from the 50-EMA on the four-hour chart. Therefore, ETH is likely to bounce from $3,000 if the altcoin regains momentum from its first area of interest.