Following Donald Trump’s election as President of the United States, rising excitement over a crypto-friendly environment in the US has sent Ether (ETH) prices up more than 37% in the past seven days, reaching their highest level since July 24.

At the time of writing, Ether is trading at $3,392 with increased demand through spot Ethereum ETFs, and on-chain metrics suggest the altcoin’s uptrend remains intact.

Ether Open Interest Hits Record High

Ether’s rally over the past seven days was sparked by a surge in ETH Long positions on the Futures market. Data from on-chain analytics firm CryptoQuant shows that Ethereum’s total open interest in the derivatives market has increased from 9.8 million ETH on November 5 to a record high of 13.2 million ETH on November 11.

“ETH futures open interest has finally hit an all-time high, showing that interest is finally returning to the altcoin kingpin,” analyst Alan noted on X, adding that the market can never ignore ETH.

Analyst Olek also noted that the increase in Ether open interest shows “increasing liquidity and market participation.”

“Ethereum is signaling a comeback, with increased activity showing that the market is ready for volatility,” Olek added.

Demand for ETH is on the rise

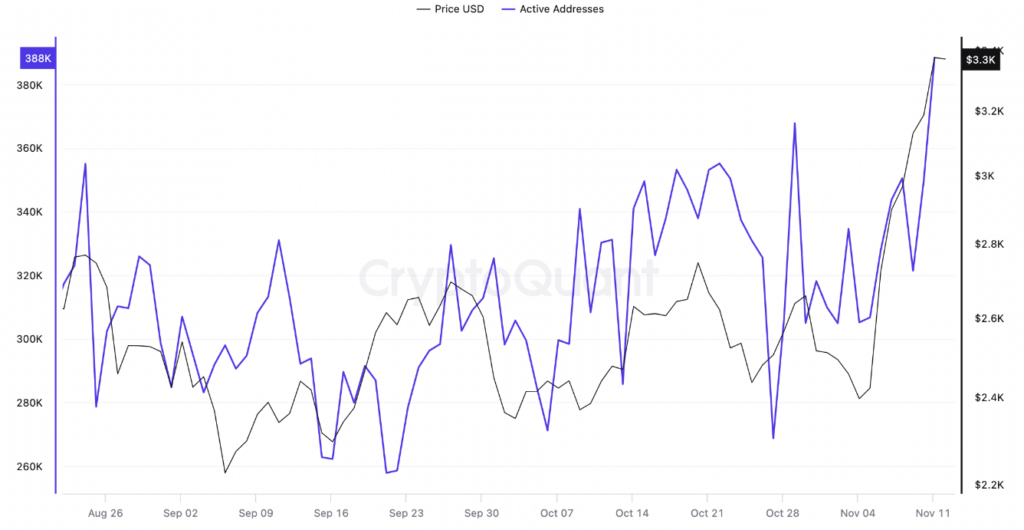

Data from CryptoQuant shows that demand for ETH has seen a resurgence in interest amid increased onchain activity, as seen by the number of daily active addresses (DAA) on the Ethereum blockchain. The chart below shows that Ethereum’s DAA has increased from 306,751 on November 5 to 388,350 at the time of writing on November 12. This represents a 26% increase, which came after Donald Trump’s victory in the 2024 US presidential election last week.

As such, onchain data shows that users are interacting more with the layer-1 blockchain, indicating an increase in the number of transactions for the Ether token.

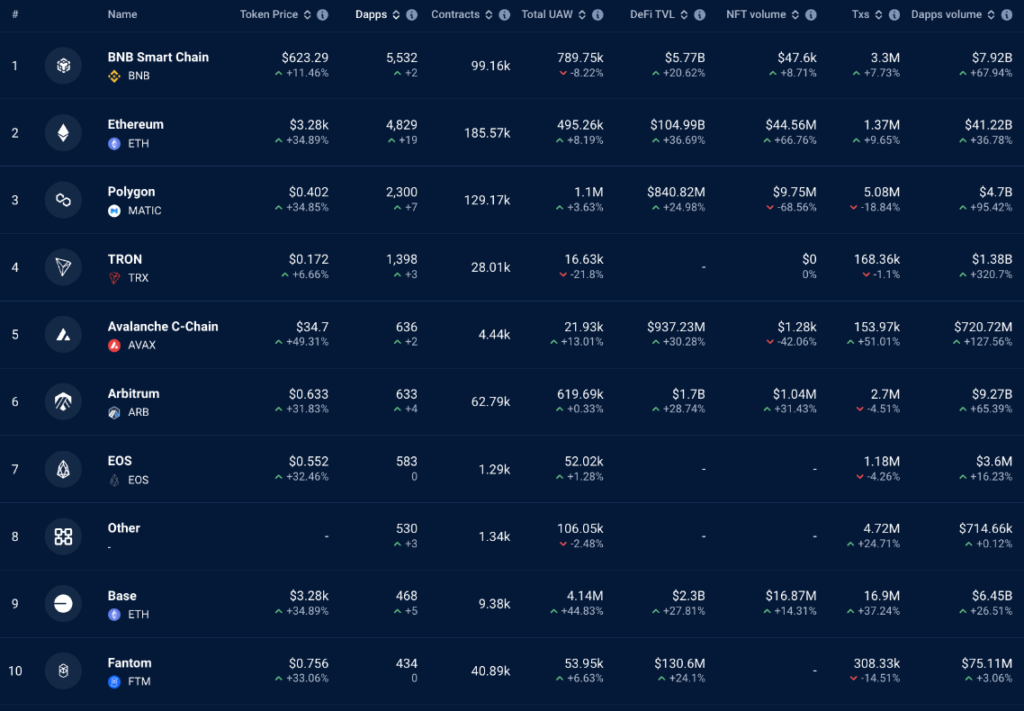

According to data from DappRadar, active addresses on Ethereum DApps have increased by 8% over the past seven days. Overall, the data is positive, especially as other DeFi metrics like total value locked (TVL), transaction count, and NFT volume have also surged over the past week.

It is essential that Ethereum’s network growth is sustained, which will drive enough demand for ETH to move towards $4,000.

US-based Ether Spot ETFs Hit $295 Million Inflows

Ether’s rally following Trump’s victory saw spot ETH ETF inflows turn positive after recording a net outflow of $73 million in the two days leading up to the November 5 election.

These investment products recorded their biggest inflow day on November 11 since their launch on July 23, with over $295 million in inflows, according to data from SoSoValue.

The Fidelity Ethereum Fund (FETH) led the way with a record $115.5 million in inflows, while BlackRock’s iShares Ethereum Trust ETF (ETHA) was second with $101 million.

The Grayscale Ethereum Mini Trust ETF (ETH) was third with $63.3 million in inflows, while the Bitwise Ethereum ETF (ETHW) recorded $15.6 million. All other U.S.-based spot Ether ETFs saw zero inflows.

Additional data from CoinShares shows that Ethereum investment products saw a total of $157 million in inflows in the week ending November 8, bringing year-to-date inflows to $915 million and assets under management to $12 billion.

This is “the largest inflow since the ETF launched in July of this year, marking a significant improvement in sentiment,” CoinShares noted in an accompanying commentary.

The latest inflows have continued a strong trend that began a week ago, suggesting continued institutional demand for Ether investment products that could push its price above $4,000 on March 12.