Bitcoin (BTC)’s rise to $100,000 has fascinated investors for years. While these psychological milestones are often celebrated by retail consumers, the real impact will come from institutional adoption and the growth of the Bitcoin derivatives market.

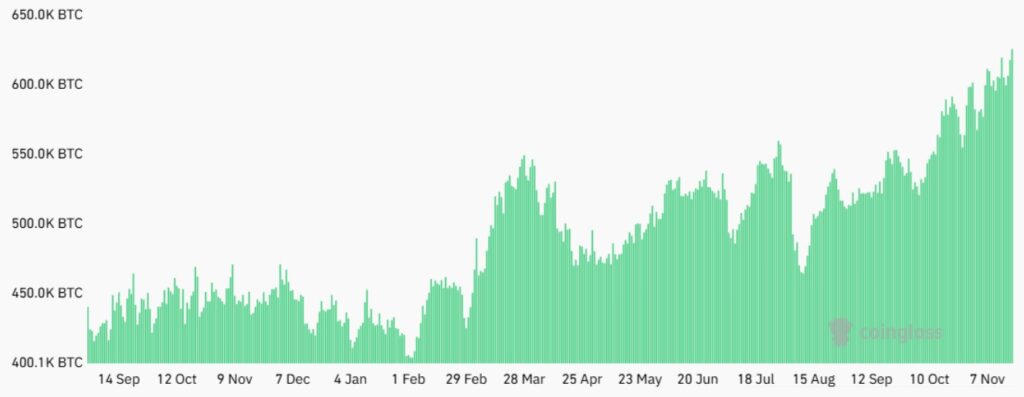

Currently, total open interest in Bitcoin futures contracts is 626,520 BTC ($58 billion), up 15% in two months, signaling growing interest in derivatives. If Bitcoin reaches $100,000, this open interest would reach $62.5 billion, representing 3.1% of the $2 trillion market cap. This contrasts with the S&P 500, where the $817 billion futures open interest represents just 1.9% of the $43 trillion market cap.

A direct comparison between Bitcoin and S&P 500 futures is unfair, as over 65% of cryptocurrency trading takes place on crypto-only exchanges like Binance, OKX, and Deribit. This number is expected to decline as spot Bitcoin ETFs eventually launch their own futures markets, especially those that offer creation in a manner suitable for institutional investors.

However, regulation alone does not guarantee adoption. For example, CBOE offered Bitcoin futures from December 2017 to March 2019, but had to discontinue the product due to low demand. Recent approvals for spot Bitcoin ETF options show progress but highlight the need for deeper integration with traditional financial markets.

Institutional Adoption: The Key to $100,000 and Beyond

Institutional adoption is critical to converting Bitcoin’s $100,000 milestone into real growth in the derivatives market. For example, spot ETF options could enable complex strategies like generating income through covered options or hedging liquidity risk. As institutions become more comfortable with Bitcoin as a reserve asset, the derivatives market will likely grow to meet their sophisticated needs.

The futures market is often confusing to newcomers, especially when it comes to short positions. Many people think these positions represent a bearish bias, but that’s not always the case. Strategies like cash and carry, where investors lock in risk-free profits by selling futures contracts while holding spot Bitcoin, create a large short position. These strategies stabilize the market rather than betting on a price drop.

One potential catalyst for Bitcoin’s surge could come from a change in corporate governance. Microsoft shareholders recently backed a fund allocation to Bitcoin, a move that signals significant intent from influential investors. Even if these plans are not approved by 2025 or are rejected by the board, the act of voting for a Bitcoin allocation has created momentum that could lead other companies to follow suit.

Additionally, Senator Cynthia Lummis’s proposal to convert U.S. Treasury gold certificates into Bitcoin and create a “Strategic Bitcoin Reserve” provides another price-boosting factor. Her bill includes a plan to purchase 5% of the total Bitcoin supply—1 million BTC—to be held for 20 years, further cementing Bitcoin’s potential as a reserve asset.

Bitcoin Derivatives Market Is a Consequence, Not a Cause

Despite the excitement surrounding Bitcoin’s journey to $100,000, the derivatives market is likely to respond to mainstream adoption rather than lead it. Retail and corporate concerns about fiat currency devaluation remain the primary driver of Bitcoin’s rise. This shift in sentiment—more so than any futures or spot ETFs—will ultimately cement Bitcoin’s role in institutional portfolios.

Lyn Alden’s research reinforces this narrative by showing a correlation between global M2 money supply and Bitcoin’s price. As governments ramp up monetary stimulus or cut interest rates, investors increasingly seek scarce assets like Bitcoin as a hedge against devaluation. As a result, a mature, liquid derivatives market will emerge as a consequence, not a cause, of Bitcoin’s price breakout.